BlitzFail

How Not to Go Off the Rails

Every year, the tech ecosystem witnesses once-promising startups go off the rails. The speed with which a unicorn can go from hot startup to turnaround — from filing for an IPO one week, to fighting bankruptcy the next — is head-spinning. These meltdowns make for sensational headlines, yet each instance is hardly unique. If one looks for underlying causes, some common themes and patterns emerge.

In this post, I identify the top reasons why fast-growing startups go off the rails (or “BlitzFail”). The issues have three things in common: first, they are existential; they are capable of derailing a startup. Second, they are surprising; they tend to go undetected for awhile, then manifest suddenly. Third, they are common enough to occur across many startups.

My hope is that outlining these pitfalls will help founders avoid them.

1) Unit Economics

Nothing can give a startup the illusion of success like negative unit economics. This occurs when a startup is selling a product for less than its variable cost. Hypergrowth is easy when you’re selling dollar bills for 90 cents. When the product is priced correctly, however, growth may stall, or even worse, the startup may discover it did not really have a business.

If a startup is not maturing its finance function to keep up with its growth, it may discover a margin problem too late, when the company is already operating at scale and a brutal restructuring is necessary. This trap is easy to fall into because there’s nothing unusual about startups losing money. The question is which type of money they’re losing. Losing money at the corporate level is ok; losing money at the unit level is not. Proper attribution is necessary to tell the difference.

This is an important muscle that startups tend to under-develop. Startups rationalize margin problems as something they can fix later. After all, the most important thing is to find product-market fit, then beat the competition. Profits can be optimized after winning the market. This is generally true — provided there are profits to be optimized. The sudden realization that there might not be any can cause a BlitzFail, even on the eve of IPO.

The public markets scrutinize margins much more closely than venture investors. Early-stage investors have fewer data points and are mainly trying to figure out if a new idea will broadly catch on. Growth investors look at unit economics more carefully. The bar goes up with each round, and the startup that does not upgrade its financial standards over time will suddenly find it much harder to fundraise.

For more on this topic, see my post The Gross Margin Problem.

2) CAC

Distribution is one of the toughest problems for startups — even the startup that appears to have product-market fit. It is not uncommon for promising startups to saturate their initial distribution channel, at which point growth will stall or, to maintain it, the startup will begin overpaying on customer acquisition cost (CAC). It is generally considered uneconomic to spend much more than first year’s revenue on CAC. Another rule of thumb is that LTV (the lifetime value of a customer) should be at least 3X CAC.

Examples of channel saturation include: graduating from a startup accelerator whose network delivered the initial customers; running out of email lists or running into email deliverability limits; burning out a viral channel; running out of high-quality inbound leads so sales reps have to spend more time prospecting. In short, the low-hanging fruit dries up.

To avoid a surprise, startups should move away from a “blended CAC” concept as soon as possible and attribute CAC by channel. This requires tracking conversion rates by lead source all the way through the funnel. A common issue at SaaS startups is that the highest quality lead sources, like word of mouth, are harder to scale than the lowest quality channels, like advertising. If the effectiveness of these channels is blended, it will lead to overspending on unproductive channels and CAC will deteriorate.

3) Churn

Churn is a well known problem but remains a time bomb for many startups because of the lag between customer acquisition and renewal. It takes a year for an annual deal not to renew. If the startup has recently experienced hypergrowth, it may take some time to recognize that new cohorts are troubled. Instrumenting customer health metrics (like NPS and engagement) can prevent surprise and aid in fixing CSAT issues before they turn into churn.

Benchmarks for churn depend on the type of customer. As a rule of thumb, enterprise logos should retain about 95% on an annual basis, SMB logos about 85%, and startup logos about 75%. Consumer businesses have even worse retention; these businesses typically don’t work unless there’s a hard-core contingent of subscribers (a cohort within the cohort) who will stick around forever.

What’s more important than logo retention rates are dollar retention rates. It’s important for SaaS businesses to have dollar retention over 100%, meaning that ARR expansion from retained customers exceeds lost ARR from churned customers. The beautiful thing about businesses with 100%+ revenue retention is that they just keep compounding; the startup begins the year with all of last year’s revenue and keeps stacking new cohorts. However, if revenue retention is below 100%, it means the bucket is leaky and it may be more productive to plug the holes than try to fill it up faster.

4) External Dependencies

Even a startup with great metrics can have the rug pulled out from under it if it has a platform dependency on another company. External dependencies create existential risks. But since new platforms offer opportunities for startups, it’s a risk startups often must take.

The opportunity can be compelling even if the underlying platform is uncooperative. For example, PayPal spread on eBay and Plaid scraped banking websites without official access or APIs. The old adage “it’s better to ask for forgiveness than permission” is applicable here. Seeking the permission of a big company to build on top of them, if they do not already have open APIs, is a Biz Dev dependency that will delay a startup to death. By contrast, going over the head of BigCo to acquire their users directly (as PayPal and Plaid initially did) will put the startup in a position of leverage. At that point, negotiations seeking a commercial relationship make sense as a way to mitigate risk. But critically, in those negotiations, delay now favors the startup; the longer its growth continues unabated, the harder it is for the platform to switch it off.

In general, the playbook for startups is to race onto new platforms to bootstrap growth, then race to diversify off them; to use Biz Dev to cement a position, rather than to seek permission in the first place. However, there is risk to these tactics — if the underlying platform turns hostile before the startup can achieve escape velocity, the result can be a BlitzFail.

5) Regulatory

Regulatory problems have derailed a number of startups that tried to hack legal requirements or had a cavalier attitude towards compliance. In the early days, the fact that the startup is not on many people’s radar may lull the founders into a false sense of security regarding their non-compliance. In reality, regulators and competitors simply haven’t noticed yet. Growth changes that by attracting scrutiny. At that point, “compliance debt” will come due. Painful though it may be, the best course for founders who find themselves in that position is to remediate, rather than ignore or hide, the issues. It’s usually not the initial mistake but rather the denial and doubling down on a losing hand that leads to disaster (e.g. Theranos as the extreme case).

Innovative startups often fall into regulatory gray areas because their disruption wasn’t foreseen by regulators or even possible at the time the rules were written. So what is a startup to do? First, scrupulously comply with rules that are black and white. Failure to do so will eventually precipitate a Napster-like shut-down or cause a compliance scandal that will damage the startup’s credibility and the case for innovation. But when the rules are gray, the startup should push forward while vigorously explaining and advocating for why what it’s doing is in the public interest and permissible under a reasonable interpretation of existing statutes. The key is for the startup to be able to publicly defend its approach. Clandestine non-compliance is a recipe for BlitzFail.

6) Sales Behavior

So often, the sales department seems to be the locus of bad behavior in the startup that’s gone awry. Culture and HR problems, compliance issues, missed projections or restatements, and oversold customers are all common issues. The root cause is that Sales is the only team in the company operating under an incentive plan which dictates that sales reps earn a multiple of their base salary or get fired. This draconian incentive is necessary to attract, motivate, and retain the best sales people but also creates a crucible out of which some undesirable behaviors can be forged. In other words, incentives work, but you may be surprised at some of the behaviors that you are incentivizing.

When the sales incentive plan is unaccompanied by a sales compliance regime, the short-term objective of hitting quota will override any other considerations of what is good for the business. This is called “short-termism.” Examples of this behavior include:

over-selling or misrepresenting the product, which closes a customer but causes downstream churn or NPS problems in customer support (by which time the sales rep is no longer involved);

callously handling any prospect who says no or burning any other relationship that doesn’t immediately lead to quota credit (“drive-by reps”);

fudging revenue recognition by obtaining quota credit for sales that are in fact conditional;

promising custom work to close deals, which effectively sells the engineering lifeblood of the company;

simply ignoring non-commissioned but necessary activities (like compliance) in favor of commissioned activities, and

seeking to change the metrics if the original metrics aren’t hit.

It takes strong sales processes, culture, and leadership to keep the sales team operating at peak production while staying on the rails. Good sales organizations will develop an ideal customer profile, create sales collateral, hold quarterly sales kickoffs, and constantly retrain on product changes so that sales reps aren’t just making it up as they go along. There will also be checks and balances on the Sales org, like outside functions for regulatory compliance and revenue recognition. But most of all, the leadership will understand that it’s their job not just to hit the number, but to enforce ethical sales behavior and protect the long-term interests of the business. When the head of sales or, even worse, the founder/CEO suffers from short-termism and acts like a jumped-up sales rep, the company quickly takes on an “inmates running the asylum” feel. It won’t be long before a BlitzFail comes home to roost.

7) Mechanical Turk

Mechanical Turk occurs when a startup compensates for product gaps by doing the work by hand instead of with software. To some degree, every company does this every time it addresses a customer support case. The problem is when the dependency on human fail-over grows to the point where the startup is turking (faking) a lot of its product capabilities. In the extreme case, this is a form of fraud. But in the early stages, it’s a slippery slope that is easy to rationalize: Eventually, the startup believes, it will go back and automate the human pieces; in the meantime it would be foolish to turn down real customers and revenue. Indeed, revenue does grow (“product-market fit!”) so everything seems fine on the surface.

The problem is that it’s hard to go back and automate — in fact there’s now an internal constituency whose interests are not aligned with that goal — and meanwhile the startup becomes culturally dependent on throwing bodies at problems. Eventually this breaks. The startup’s burn escalates, causing greater scrutiny of the numbers, which reveals a gross margin problem as soon as costs are properly attributed to COGS rather than overhead (see #1). At that point, the reckoning may be quite severe as the startup must suddenly find a way to pay down all the “operations debt” that has been accrued.

Founders should avoid these situations by rejecting the shibboleth to “do things that don’t scale.” For growth startups, this is generally bad advice. The whole point of technology is to figure out the most elegant, scalable solution.

8) Founder Psychology

At the heart of most rail-jumping behavior is founder psychology. The founder/CEO pushes things too far, not on one dimension but on a host of them. It’s almost like the founder’s ability to “run through walls” causes them to stop noticing those walls — until they finally run into one that’s made of concrete. Founders with this type of personality are described in similar terms: crazy/aggressive/visionary. When all the graphs are up and to the right, “crazy” means something positive (as in “you are not crazy enough!”), but then when things implode, it suddenly becomes a pejorative (“you’re crazy!”). Nobody is more bewildered than the founder that the same qualities that were being celebrated just a short time ago are now being cited as cause for their removal.

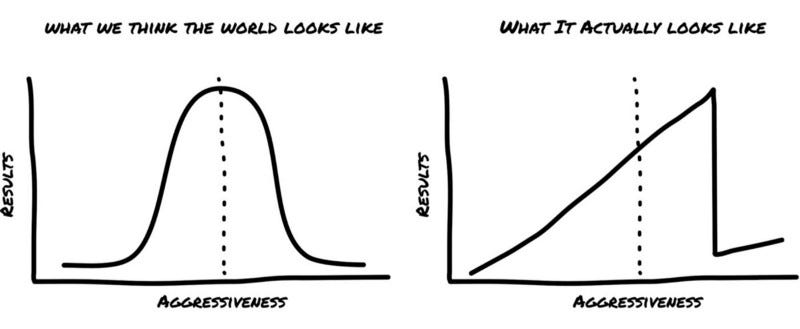

The key to understanding the difference between good crazy and bad crazy is that the world does not follow a normal distribution. Founders do need to be far more aggressive and visionary than the mean. In fact these qualities keep getting rewarded by the world far beyond what a “sane” person might think. But still, there is a limit, and founders who go too far will jump the shark (see diagram). Ultimately, founders can only be as visionary as their ability to execute will allow. If they go beyond that, visionary becomes delusionary.

Aggressiveness is rewarded until the founder pushes it too far and jumps the shark.

To avoid this danger, founders need to be self-aware and seek to balance their psychology. Ideally they choose board members and advisers who fill in missing skills and provide an experienced sounding board. Leaders should also closely examine KPIs and financials, encourage dissent, and seek disconfirming evidence to make sure they’re not losing perspective. They should relish the opportunity to have their plans be socratically challenged by the board. When founders “shoot the messenger,” dismiss inconvenient metrics, or see board conversations as an imposition, it’s a huge red flag.

9) Company Culture

The simplest way to understand company culture is as a macrocosm of the founder’s psychology. The strengths, weaknesses, and internal struggles playing out in the founder’s head will be writ large across the company. If the founder is hyper-competitive, the culture becomes very competitive (e.g. young Bill Gates / Microsoft). If the founder is corporatist, the culture becomes stuffy and hierarchical. If the founder likes to fight, the culture becomes hyper-aggressive. If the founder dithers, the culture feels adrift. If the founder cuts corners, the culture becomes reckless.

Founder behavior gets role-modelled across the company through both subtle cues and overt rewards. The founder defines the values and catechisms of the new endeavor. Even when the catchphrases seem to exhort undesirable behavior, like breaking things or firing before aiming, the founder (in shades of Animal Farm) explains why this is actually good. If growth takes off, it’s proof that the unique culture is working, which intensifies it. Warning signs are dismissed. In fact, no matter how outlandish the behavior, as long as the company keeps growing, it must mean that the founder has discovered some hitherto unknown secrets of building a big company. Soon everyone is drinking the Kool Aid.

Thus, crazy founder usually means crazy culture too. A culture problem exponentially multiplies the founder psychology problem. It’s no surprise that there are always sensational details about the cultures of startups that have gone off the rails.

In the same way that founders should seek to balance their own psychology, they should seek to create a healthier company culture by balancing the psychology of the “hive mind.” This starts with choosing the right co-founders. The strong founder will naturally have a blind spot with respect to their worst traits so the best company cultures are the result of a yin/yang relationship. For example, Jobs brought the maniacal vision while Woz brought the heart. It’s always good to have a Woz.

Values must also mature over time. What works in the early stages doesn’t work later. “Move fast and break things” doesn’t work at massive scale, which is why Facebook changed its famous motto to “move fast and build scalable architecture.” Similarly, institutionalizing values like hustling, hacking, shooting first and asking questions later, and cutting corners may work in the early days but leads to catastrophic consequences later on when the catchphrases percolate down to hundreds or thousands of junior employees who have their own interpretations of what they might mean.

As the company grows, it is also wise to create more structure around HR and culture, such as by adding formal onboarding and training programs, surveying employee happiness, and stressing the virtues of operating with integrity. Growing size without structure creates chaos.

10) Commoditization

Commoditization occurs when the rest of the tech ecosystem catches up to a startup’s innovation. At that point, the startup’s pricing power is undercut, or worse, its functionality is simply assimilated by a larger player and becomes table stakes of other products. The startup discovers that it was “a feature, not a product.” It is incumbent upon the startup to stay ahead of the competition and develop network effects or other advantages of scale before this can happen. The lock-in that a startup can obtain by being the first to scale with a new idea is the imperative for blitzscaling in the first place.

In a sense then, commoditization is the counterweight to all the other items on this list. It argues for the startup to move fast even at the risk of getting some things wrong. It may be better to risk a BlitzFail than never to blitz at all. This is why founders run around with their hair on fire. Certainly if they tried to do everything perfectly, they might move too slowly and succumb to the Red Queen Effect (named after the character in Alice in Wonderland, who says “it takes all the running you can do, to keep in the same place.”) The point of this post is not to argue that founders shouldn’t move fast and take risks but rather that they do so with greater awareness of the tradeoffs and pitfalls, so they can blitzscale and not BlitzFail.

11) Macro Shocks

About once or twice a decade, a macro shock affects the startup ecosystem, causing a re-evaluation of fundraising criteria. High-burn startups that are caught flat-footed are often wiped out. In 2000–2002, it was the dot-com crash. Almost overnight, funding dried up, and for the next two years, startups slowly ran out of money and died. In 2008–2009, the Great Recession triggered by the real estate bubble wasn’t focused specifically on startups but depressed valuations and made it harder to fundraise (“RIP Good Times”). More recently, we’ve seen the SoftBank/WeWork crash, which has caused a re-evaluation of some late-stage valuations and prompted a refocusing on burn and unit economics (see #1).

Startups with great products and business fundamentals will generally weather these shocks, but startups that don’t have their house in order may suddenly find the day of reckoning is at hand.

Even absent a major economic downturn, a shock can occur simply because a space is no longer “hot.” When a space is hot (e.g. the recent crypto boom), all the normal rules of investing are suspended. Startups raise huge amounts of capital at high valuations with no product, customers, or revenue. Then, when the bubble pops, the normal rules suddenly reapply, and valuations plummet to the level implied by metrics. Founders who are slow to react to the new reality (e.g. by slashing burn to a level commensurate with their revenue) will be swept away.

Micro-bubbles are constantly occurring as spaces fall in or out of favor with VCs. Founders in a hot space should take the opportunity to fundraise (“make hay while the sun shines”) but anticipate that they may not be in favor forever. If you raised peak money from SoftBank, for example, that’s good on you, but if that causes you to sharply escalate your burn because you think there will always be a bigger better deal down the road, that’s a recipe for BlitzFail. Make sure you always have a sufficient cash cushion to weather a storm, and if it’s necessary to cut burn, do it as soon as possible to give yourself the additional runway.

The Meltdown

Broken fundraising processes are frequently the trigger for a startup’s implosion. Since everyone internally is drinking the Kool Aid, it usually takes an external reality check to pop the bubble. In addition to a failed fundraising process, the pinprick could come from a press expose, a lawsuit, a government investigation, or all of these things at once. When it rains, it pours.

When a BlitzFail occurs, it’s usually not just one item on this list that derails the company but multiple interrelated issues. For an example of how this could happen, consider the following narrative, some version of which has played out at countless high-profile startups:

Visionary founder who has experienced failure in the past finally has an idea that seems to be catching on. Since the main reason their previous effort failed was lack of product-market fit, they are determined to make the most of the early traction and pour on the gas. Initially, everything is up and to the right, and since Silicon Valley is a machine for helping hot companies scale, resources flock to this company in the form of venture capital and employees.

Copycats enter the market (#10). Determined not to cede an inch to competitors, the founder steps on the gas even more, prioritizing aggressive growth above everything else. The founder is praised for their maniacal focus (#8). An incipient finance team is added but is not a true partner in decisions; it’s really picking up after the founder. The company’s infrastructure starts to buckle under the added scale; the product feels like it’s being held together with popsicle sticks and bubble gum; and customer service issues are piling up — but there’s a solution for that. Bodies are quickly hired until the product can get fixed (#7). There is no formal onboarding process for all the new hires but they learn the founder’s catchphrases and ideology so there seems to be a kind of acculturation happening (#9). The sales/growth team is crushing it so there is very little oversight, except to get rid of obvious non-performers (#6). Growth continues so funding continues unabated.

But now stress fractures are starting to appear. Preliminary reports from the finance team show that burn is growing uncontrollably and the gross margin picture is unclear (#1). The lawyers are concerned that the company is behind on various compliance obligations (#5). The HR department warns that employee complaints are stacking up (#9). Churn is suddenly rising amidst all the customer support issues (#3) so the CS leadership is changed. The founder knows something is wrong but figures it’s just the result of pushing hard; after all, you have to break a few eggs to make an omelet. The only issue that is truly concerning to the founder is that the sales/growth team seems to be struggling to hit the new higher targets; apparently there aren’t enough high-quality leads to go around. So the company increases spending on new, unproven channels (#2).

The company begins a new fundraising process but the markets are choppy and this one seems to be taking longer (#11). New investors are drilling much deeper on the data and asking much tougher questions about burn, margins, and CAC than in previous rounds. Meanwhile, a press report about culture problems at the company comes out at the worst possible time. The company denies the reports but is quickly contradicted by more leaks from unhappy employees. The press reports attract the attention of regulators who suddenly begin investigations into the company. Feeling mistreated, a key platform partner sues the company; in fact the company never had a solid deal with them to begin with (#4).

All of a sudden, board meetings take on a different tone. The company’s current practices are unsustainable. Its relationships with customers, partners, employees, and regulators have deteriorated. How could the founder have missed all these problems? The founder is on the defensive and denies the charges. This makes the board wonder, is new leadership necessary? Suddenly the board is calling for the founder’s head. The financing process falls apart and the company has precious time left to fix all the issues. One of the hottest startups in Silicon Valley has hit the wall at 100 miles per hour.

And the feeding frenzy in the press begins, with all the recriminations of how it could have happened, even though it happens every year.

Conclusion

Startups that go off the rails seem to suffer from a common set of problems. Despite having product-market fit, these startups are derailed by a set of pathologies related to hypergrowth. This post is not a critique of the desirability of hypergrowth, but rather a companion piece. Founders should understand the legitimate governors on growth. Hopefully this post gives them a better sense of what those limits are. Like a high-performance sports car that can dangerously redline, startups should seek to go as fast as possible, just not faster.

How does a BlitzFail happen? “Gradually and then suddenly,” to use Hemingway’s description of bankruptcy. As in a bankruptcy, the startup gradually accrues too much debt. Tech debt is a well understood concept. But there is also financial, managerial, compliance, cultural, and operational debt. Founders should seek to pay down this debt over time. Otherwise, it may suddenly come due all at once.

Growth may be the most important thing but it’s certainly not the only thing that matters at a startup.

Fascinating writeup. I especially find "Founder Psychology" to be very true. I have seen this time and time again with founders and how far they have pushed the crazy scale. It is a delicate balance that takes self-awareness and discipline. David, how do you keep yourself in check? Thank you again for sharing.