The Burn Multiple

How Startups Should Think About Capital Efficiency

As the economic crisis deepens, capital efficiency becomes a more pressing issue for startups. Not only is it necessary to maximize runway, it also plays a larger role in how investors evaluate companies. While growth is always prized during good times or bad, investors increasingly scrutinize burn and margins during downturns. Startups whose burn is too high relative to their growth will find it hard to fundraise. Founders should be prepared for this shift in emphasis. This post provides a framework for how to think about capital efficiency.

How to Measure Capital Efficiency

Two simple ways to measure capital efficiency are the Hype Ratio and Bessemer’s Efficiency Score:

Hype Ratio = Capital Raised (or Burned) / ARR

Efficiency Score = Net New ARR / Net Burn

I think Bessemer has the right idea but I prefer to flip the numerator and denominator, so the ratio is an annualized version of the Hype Ratio. I call this the Burn Multiple:

Burn Multiple = Net Burn / Net New ARR

This puts the focus squarely on burn by evaluating it as a multiple of revenue growth. In other words, how much is the startup burning in order to generate each incremental dollar of ARR?

The higher the Burn Multiple, the more the startup is burning to achieve each unit of growth. The lower the Burn Multiple, the more efficient the growth is.

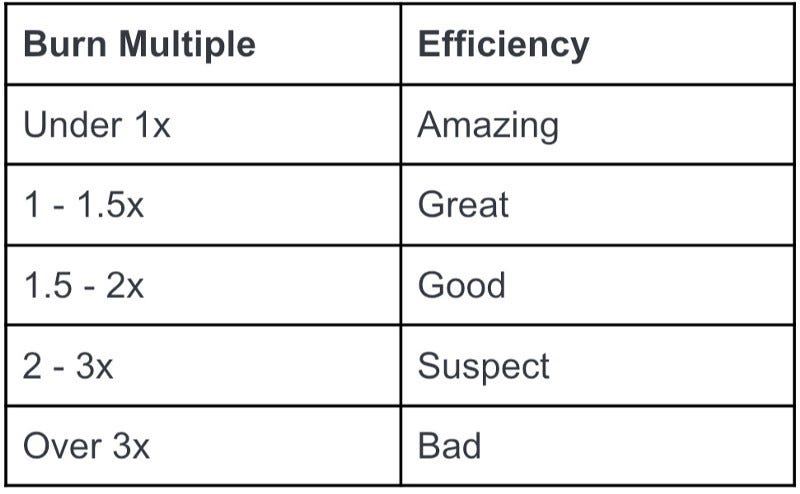

For venture-stage startups, these are reasonably good rules of thumb:

I like this ratio because it’s an easy way to judge whether burn is too high in any given month, quarter, or year.

For example, Q1 just ended and it’s time for a board meeting. The startup reports that it burned $2M in the quarter while adding $1M to its ARR. That’s a 2x Burn Multiple — reasonable for an early-stage startup. On the other hand, if the company burned $5M in Q1 to add $1M of net new ARR, that’s a terrible Burn Multiple (5x). It should probably cut costs immediately. That company is spending like a later-stage company without delivering later-stage growth.

Too many startups report their growth without contextualizing it as a function of investment. If extraordinary investment (3x burn or more) is required to deliver that growth, it’s an indicator that product-market fit isn’t quite what it appears to be or there’s some other problem in the business.

A Measure of Product-Market Fit

One can understand why VCs might want to use the Burn Multiple to help assess the quality of product-market fit. The startup that generates $1M million in ARR by burning $2M is more impressive than one that does it by burning $5M. In the former case, it appears that the market is pulling product out of the startup, whereas in the latter case, the startup is pushing its product onto the market. VCs will make inferences about product-market fit accordingly.

A Proxy for Everything Else

The beauty of the Burn Multiple is that it’s a catch-all metric. Any serious problem will eventually impact the Burn Multiple by either increasing burn, decreasing net new ARR, or (most tricky) increasing both but at disproportionate rates. For example:

A gross margin problem — If the company spends too much on COGS in order to deliver the product or service, its burn will increase rapidly as it scales. If there’s not operating leverage in the business, the Burn Multiple will not improve with scale.

A sales efficiency problem — If CAC is prohibitive or sales productivity is diminishing, burn will increase relative to new ARR, causing the Burn Multiple to worsen even though growth continues.

A churn problem — Churn will net against the denominator of the Burn Multiple, causing the multiple to increase. A leaky bucket makes it hard to grow efficiently.

A growth challenge — If growth is stalling, the company may seek to compensate by spending more on marketing, give-aways, discounts, or promotions. That will be picked up in a higher Burn Multiple, as burn rises faster than new sales.

A founder leadership problem — If the founder lacks the skill or will to control burn, that will show through in the Burn Multiple.

When is “Bad” Acceptable?

When is a “bad” multiple acceptable? Mostly in the earliest years, when sales are incipient and the product is still being built. Obviously if the startup is pre-revenue, net new ARR will be zero so the ratio will not even compute. That’s fine if a startup is still in the Wilderness Period; the founders should focus on keeping burn low and crossing the Penny Gap as quickly as possible.

In theory, a longer R&D period can be justified if there’s a substantial tech moat. However, if you believe the extra burn will create a tech moat, you should also believe that there will be less competition later on, so your Burn Multiple should catch up rapidly once you start selling.

A startup that over-burns is effectively claiming that its sales will be spring-loaded. The fact that this rarely turns out to be true is an argument for getting to market quickly with the lower-burn “embarrassing” version of the product and then iterating.

Burn Multiple by Stage

The Burn Multiple should improve as the startup matures. For example, a seed stage company might have a Burn Multiple of 3 because it just started selling. After the Series A, it might drop to 2. After the Series B, when the sales team should be operating at scale, the expectations for efficiency increase even more. Eventually, for a company to become profitable, burn must reach 0, which implies that the Burn Multiple should also approach 0 over time.

If the Burn Multiple is going in the wrong direction as the startup matures, that’s a indicator that something is wrong, even though headline growth might still be increasing in nominal terms.

What Founders Can Do

The Burn Multiple suggests some concrete steps that founders can take. First and most obviously, they should keep salaries and expenses low in the early days — not just to extend runway but also to strengthen the impression of product-market fit for when they go out to raise a venture round. It’s an easy way for founders to put their best foot forward.

Second, founders can always improve their Burn Multiple by cutting costs, because Burn Multiple instantly adjusts to the most recent period. By contrast, the Hype Ratio is based on total capital raised, and therefore permanently dings a startup for wasted time and money. The Burn Multiple doesn’t care about sunk costs and always gives founders the chance to improve.

Finally, the Burn Multiple suggests just how far founders need to go to reduce burn to a reasonable level for a given level of growth. It may even be worth giving up some revenue (e.g. unprofitable growth) if it brings the Burn Multiple down to a much healthier ratio.

Conclusion

In a tough fundraising environment, it won’t just be growth but the efficiency of growth that are seen as the key indicators of startup performance. Tracking the Burn Multiple is an easy way for founders to make sure that burn isn’t getting ahead of traction. Over time, it also reveals important information about whether incremental spend is working.

As everyone in the startup ecosystem scrutinizes their runway and makes tough decisions about how to extend it, the Burn Multiple is a useful rule of thumb for founders and investors alike to keep in mind.