Individuals vs Teams: Who’s the Better Customer?

Go for Teams: that's where the money is. Individual plans are primarily good for lead gen.

A common dilemma for SaaS founders is whether to focus on individual users or teams as the primary customer. This decision has important implications for pricing and packaging as well as product design. In my experience, Team plans are where the money is, and therefore where founders should focus their energy and resources. Individual plans can be useful to generate leads, but their long-term revenue potential is significantly smaller.

Teams > Individuals

There are three main reasons for the superior economics of Team products:

Deal Sizes

Team products have larger initial contract values as a result of the ability to sell multiple seats. By contrast, the small deal sizes of Individual products may be insufficient to justify the cost of a sales team. Unless the Individual product is highly viral, it will be easier to build a distribution strategy for a Team product.

Retention

Team products are stickier than Individual products. To use a gaming analogy, multiplayer mode is more engaging than single-player mode. Users can do more interesting things when coworkers are part of the experience; value creation is higher.

Once a team is collaborating in a product, no single user can easily make the decision to leave. The decision to migrate to another tool requires coordination (aka a “rip and replace”). By contrast, a solo user can leave an individual product at any time.

Finally, collaboration provides constant opportunities for reactivation. A subscriber who stops using an Individual product is likely churned whereas an inactive user on a Team product is just one notification away from being reengaged. As long as the team maintains some minimum threshold of engaged users, it will avoid churn at the account level.

For all of these reasons, account-level churn rates for Individual plans are commonly around 5% per month, but only 1-2% per month for Team plans. This translates into much higher revenue retention for Team plans.

Seat Expansion

Team plans have the ability to add new seats as the product spreads within a company, creating revenue expansion. As a result, successful Team products have “net negative churn,” meaning that expansion from retained accounts exceeds revenue lost from churned accounts. This beautiful property is illustrated by this famous chart from Slack’s S-1:

Revenue from annual cohorts of Slack customers keeps increasing year over year, not because there is no churn, but rather because seat expansion exceeds churn.

Without the benefit of seat expansion, Individual plans suffer from a one-sided attrition. Cohorts keep shrinking rather than growing. To counteract this dynamic, Individual products can try to upsell more expensive plans or new products, but this is much harder than adding new seats.

As a result, it is not uncommon for Individual plans to suffer ~50% per year churn in subscribers and revenue. At that level of churn, the SaaS vendor is effectively rebuilding its business from scratch every two years. It’s impossible to build an extremely valuable SaaS company this way.

B2B > B2C

The ability to offer Team plans is a major advantage of B2B SaaS. By comparison, B2C SaaS is limited to Individuals plans. Frankly I’m skeptical of valuations in this category. Investors are currently paying SaaS multiples for these companies because they are ARR businesses, but without seeming to understand the difference between cohorts that are shrinking versus those that are growing every year. With only ~50% per year retention, these B2C SaaS businesses are effectively an arbitrage on marketing CAC (customer acquisition cost). There’s no long-term business.

Two highly successful B2C subscription businesses are Netflix and Peloton. Why have they done so well? Netflix spends billions per year on original content to retain subscribers. Peloton takes over a room in your house, physically reminding you to engage with the product. These are exceptions that prove the rule because they have unique retention strategies. Both companies are selling more than a short-term subscription.

Individual plans are a good business only when retention is unusually high (e.g. churn under 2% per month) or if the retention rate approaches a long-term asymptote (so initial churn may be high but there’s a “cohort within the cohort” that sticks around forever). Moreover, a business can afford high churn rates only if CAC is very low or free.

Hybrid Strategies

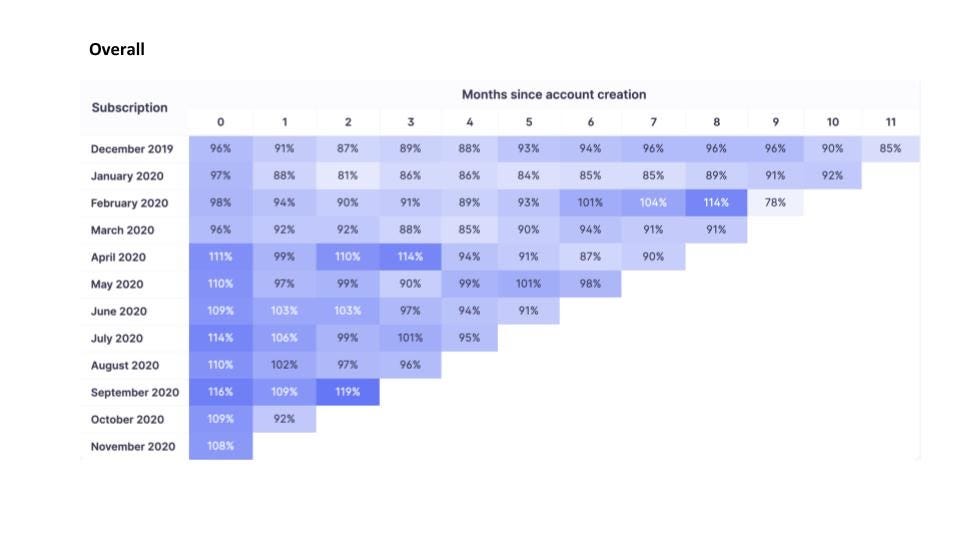

When a B2B SaaS company has both Individual and Team plans, how should it think about the quality of its revenue? As an example, Craft recently evaluated a Series A investment that had both types of plans. Taken together, revenue retention for the Overall business looked unimpressive, at about 85% for the year:

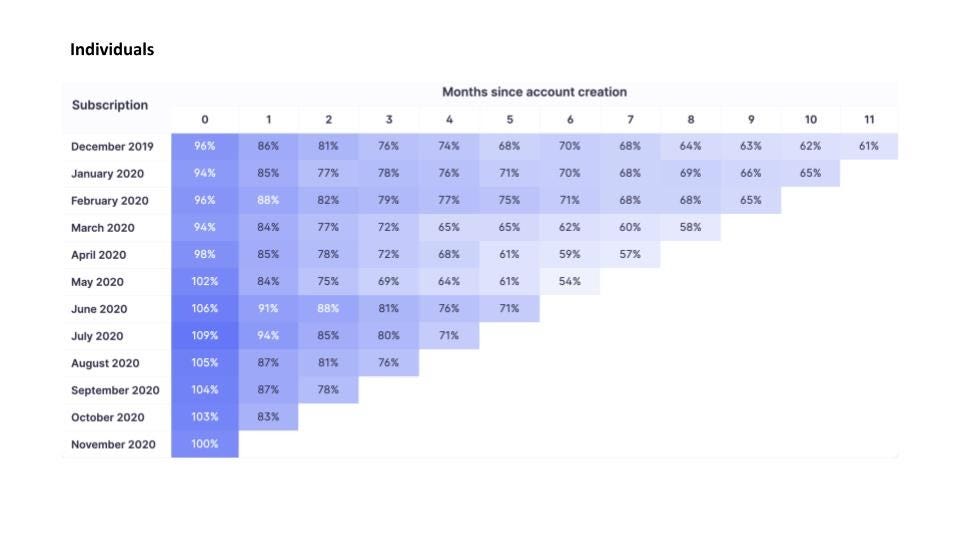

But when we broke apart the Individual and Team plans, we saw a very different picture. The average masked two extremes. The Individual plan had about 60% annual revenue retention, which is poor (but not uncommon for Individual plans):

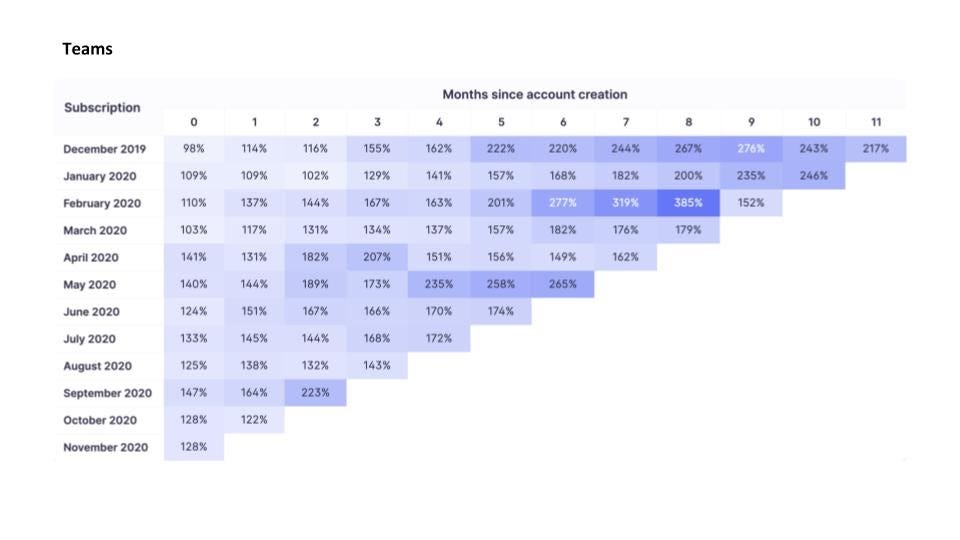

On the other hand, the Team product had roughly 200%+ net revenue retention, which is fantastic:

Most importantly, revenue cohorts for the Team product were compounding over time whereas revenue cohorts for the Individual product were shrinking. This is the key point: The Team product was creating a growing revenue base whereas the Individual subscriber base was steadily deteriorating.

How does Craft evaluate a business like this? We placed zero value on ARR from the Individual business but valued the Team business at a very high ARR multiple. We ended up leading the Series A. Other VC firms that didn’t analyze Teams vs Individuals, and just looked at the Overall chart, completely missed what we were so excited about.

When Individual Plans Make Sense

Although Team plans have superior economics, there are cases where it may make sense to focus on an Individual plan first.

First, it may be easier to build single-player mode than multiplayer mode. Some SaaS products need to figure out how to create a great experience for one user before they contemplate how to bring value to a whole team. Certainly, if the experience of each individual on a team is mediocre, expansion will be difficult.

Second, Individual plans can be valuable as an engine for lead generation. This is why a lot of SaaS products offer “first user free.” This is a smart pricing strategy. Since most Individual plans don’t create a lot of long-term value on their own anyway, why not give them away in order to drive acquisition for the Team business? (However, “first user free” won’t work if teams can loophole pricing by going through a single user, so try to develop features that make this impractical.)

Finally, if there are real costs to offering the service, you may need to charge power users under an Individual plan. But unless retention is unusually high, don’t confuse what is effectively a financing subsidy with what is the real long-term business. Customer revenue cohorts that grow forever should be the goal.

Conclusion

In general, B2B SaaS companies should focus on Team plans, with their magical property of compounding revenue. Team plans build on a solid long-term foundation whereas Individual plans are the definition of a Leaky Bucket. In those cases where it makes sense to build the Individual plan first, try to find the use cases for sharing and collaboration as soon as you can. Teams are the ultimate destination.

fuck. i think my brain just got a bit bigger. thx.

What are the economics of individual products guised as team products i.e individual products with a team plan but do not intuitively provide team collaboration?