The Pipeline Metrics That Matter

Accurately tracking your sales pipeline is vital for forecasting growth and improving your go-to-market.

In a previous post, we defined The SaaS Metrics That Matter to explain the growth, retention, and efficiency metrics that every SaaS company should be tracking. This post expands on that topic by breaking down the most important sales pipeline metrics to add to your reporting stack.

Analyzing sales pipeline is vital for forecasting future growth and learning where your product and GTM process needs to improve, but too often we see startups turn to unreliable heuristics like top-down growth goals or how the sales team “feels” when making key decisions. Below, we detail the key pipeline metrics you should start tracking in order to make data-driven decisions.

1. Pipeline Generation Metrics

For most SaaS companies, pipeline generation is the rate-limiting factor on growth, so this is the most important place to start.

Opportunities Created

When a sales rep talks to a lead and determines they are qualified to buy the product, an opportunity is created. If the number of new opportunities is growing month-over-month, growth will be greater than linear, and the company should hire more sales reps. Conversely, if new opportunities are flat there is a demand generation problem, and more resources need to be put into marketing. Breaking down opportunities created by the marketing channel they came from can help focus the business on the highest ROI channels.

Pipeline Value Created

Sales teams should track the expected dollar value (typically in ARR) of each opportunity– summing this amount for new opportunities shows the Pipeline Value Created. This amount tends to be more accurate for later-stage pipeline; when opportunities are created a rough estimate is entered, and as sales learns which products the prospect is likely to buy this number becomes more precise.

Win Rate

Win Rate is the percentage of created opportunities that eventually become won deals. While there is a general heuristic that win rates should be ~20%, this can vary dramatically based on how individual companies define qualified opportunities and sales cycle dynamics. Multiplying pipeline value by win rate produces an expected ARR value from newly generated pipeline. To get a more precise forecast, you can break down these metrics by variables like segment (e.g. SMB, mid-market, enterprise), industry, and region.

2. Pipeline Conversion Metrics

Pipeline Conversion metrics detail how opportunities move through the sales funnel and answer two questions: 1) how long will it take for opportunities to close, and 2) where in the sales funnel is there room for improvement?

Sales Cycle Length

Sales Cycle Length is the number of days opportunities take to be won. While pipeline value and win rate show how much pipeline is likely to close, Sales Cycle Length suggests when it will close. Understanding Sales Cycle Length is essential for capacity planning: sales reps can only work so many deals at a time, so longer sales cycles means more reps are necessary. If your Average Selling Price (ASP) isn’t sufficiently high to support long sales cycles, CAC can explode and the business can become inefficient. Long sales cycles can also be a sign of weak product-market fit – generally speaking, the more the product addresses customer needs, the faster customers will buy.

Make sure to evaluate Sales Cycle Length by segment. Enterprise deals will have long sales cycles, but their high ASP can make the extra time worth it. Conversely, SMB deals should have short cycles to go with lower ASP. In every segment, find the balance that keeps CAC payback fast.

Cohorted Win Rates

Sales Cycle Length shows the average time to close, but in practice opportunities will have a wide distribution. Knowing when in the sales cycle opportunities are won, and when they are lost, is vital for forecasting ARR.

Cohorted Win Rate groups opportunities by the period they were created and tracks the percentage of opportunities that are won, lost, and remain open in each subsequent month. This metric requires creating a full history of each opportunity so you can see a “snapshot” of an opportunity’s details at a specific point in the past. This is much easier to do with software like SaaSGrid:

This cohorted view often reveals unexpected trends. For example, you might learn that many opportunities are lost in the 2nd month, but opportunities that are open past then are won at a very high rate, even if the sales cycle drags on several more months. This can help focus your team on getting your prospects through the most difficult parts of the sales cycle and eventually increase win rates.

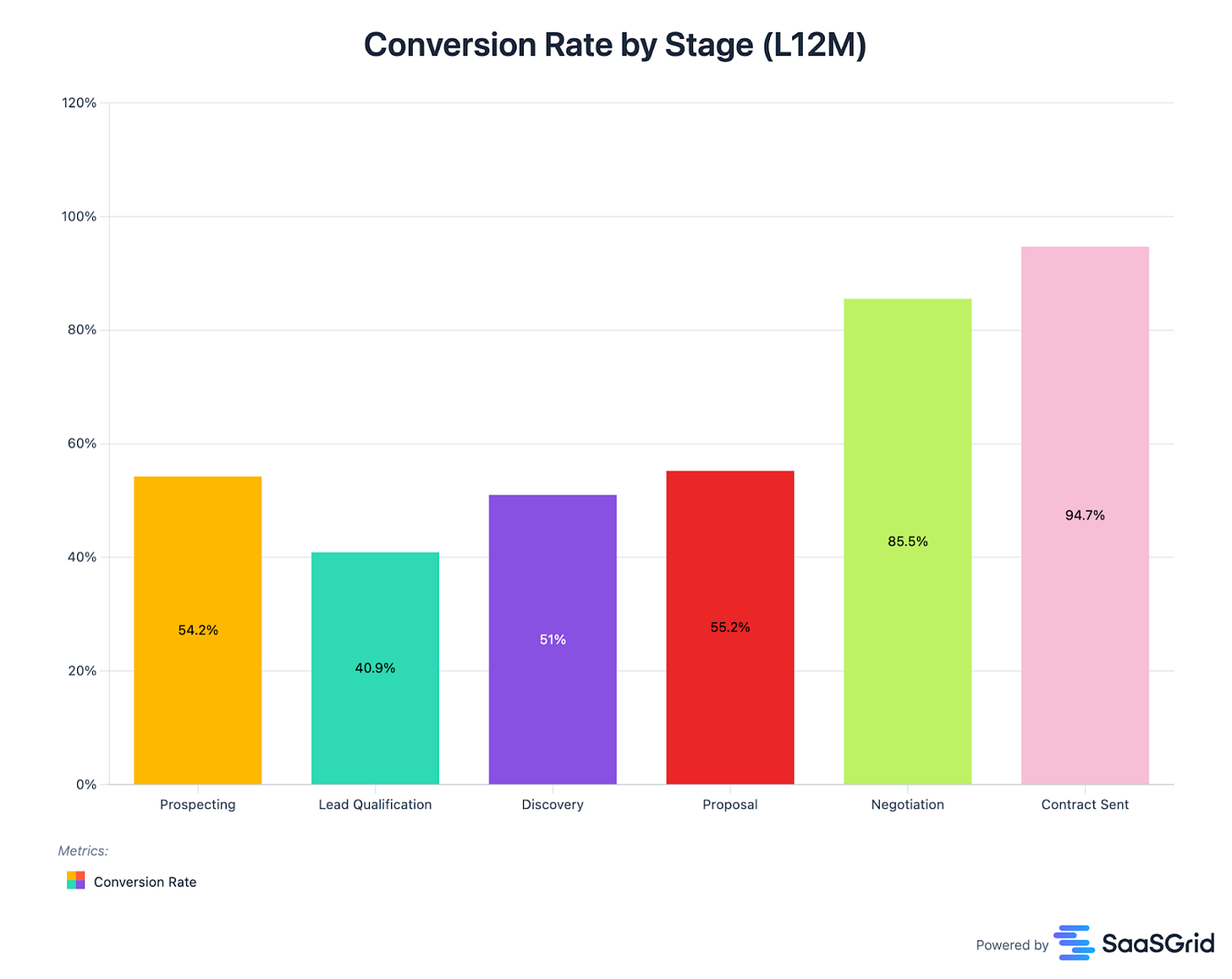

Stage Conversion Rate

Opportunity stages are how a company defines the steps in their sales cycle. While this will differ company-to-company, standard stages will look something like:

Discovery

Qualification

Overcome Objections

Proposal

Negotiation/Review

Closed-Won

Stage Conversion Rate is the percentage of opportunities that reach a certain stage and subsequently advance to a later stage. For example, a Stage 2 conversion rate of 40% means 40% of deals that reach Stage 2 eventually hit Stage 3 or later.

Stage Conversion Rates can reveal why opportunities in the pipeline are being lost, for example product gaps, pricing, or problems getting executive sponsorship. Focusing on stages with low conversion rates can be the highest ROI way to improve overall win rates.

Another variation of this metric is to look at Win Rate by Stage, which is the percentage of deals that reach a certain stage and eventually make it all the way to a Closed-Won opportunity.

Average Time per Stage

Average Time per Stage layers in the number of days your opportunities spend in each stage. A long time in a stage implies either opportunities are getting “stuck” and you should explore ways to accelerate, or opportunities are actually moving down the funnel during this time, and more stages should be added to better record status.

3. Active Pipeline Metrics

With a firm understanding of how your sales funnel operates, you can use your active pipeline to build highly accurate forecasts for the next 1-2 quarters.

Open Pipeline by Close Date

All opportunities have a “Close Date,” which indicates the sales rep’s best estimate of when the opportunity will close. Having reps be diligent and realistic with close dates is key to pipeline hygiene. Looking at the currently open pipeline by close date will tell you which opportunities will make or break the quarter. Segmenting pipeline by stage provides more detail on where these opportunities sit in the funnel.

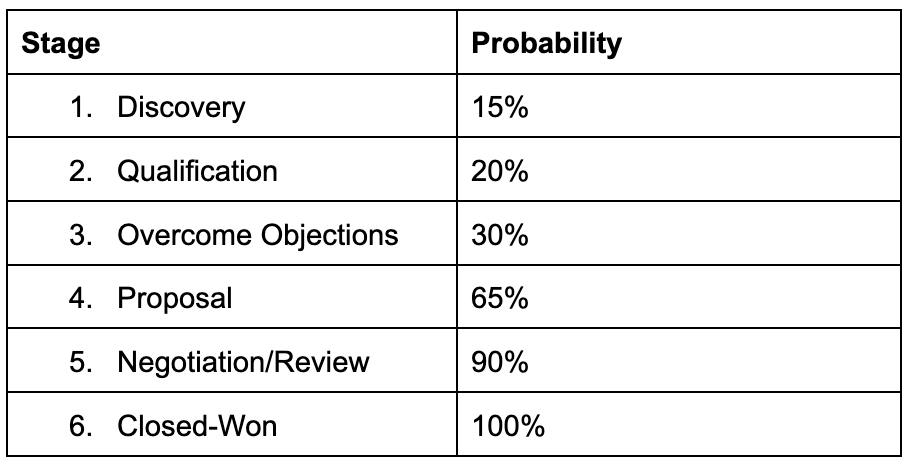

Weighted Pipeline

Weighted Pipeline is the sum of ARR x probability for open opportunities. The probability of an opportunity closing is assigned based on the opportunity’s stage. For example:

If stage probabilities are accurate, the Weighted Pipeline metric is a good representation of how much ARR will be added. Many companies use arbitrary probabilities, which hurts accuracy, but SaaSGrid produces highly accurate stage win rates you can use to update your CRM, making Weighted Pipeline a reliable metric. Once probabilities are accurate, you can look at Weighted by close date to pinpoint where the team will land.

Pipeline Waterfall

Once you understand your Weighted Pipeline for the quarter, it’s time to get tactical and review the individual opportunities. “Deal review” meetings are where the sales team’s qualitative feedback meets quantitative sales pipeline metrics: by combining what you know about likelihood to close from your pipeline metrics with your rep’s analysis of buyer sentiment, you can start to strategize using tactics like discounts, customer references, and founder calls to get your deals across the line.

During deal reviews, the Pipeline Waterfall is a powerful tool for visualizing pipeline momentum. The Pipeline Waterfall tracks how pipeline changes between two points in time. Most helpfully, you can see how your pipeline closing this quarter has changed in the past 30 days from factors like:

New opportunities created with a close date in this quarter

Opportunities increasing or decreasing in value

The close dates of opportunities “slipping” to a future quarter (an often missed category of sales forecasting)

Opportunities won and lost

Reporting with SaaSGrid

Three years ago, we released SaaSGrid to the world as an easy way to dashboard your SaaS metrics. Now we’re excited to announce that all of your sales pipeline metrics can now be tracked through SaaSGrid as well.

SaaSGrid integrates directly with your Salesforce or HubSpot account and automatically produces standardized and auditable pipeline metrics. These metrics can then be combined with the growth, retention, and efficiency metrics that SaaSGrid already tracks to create customized dashboards that serve as the single source of truth for your business.

You can read the details of how SaaSGrid calculates these metrics in our Metrics Library. To learn about using SaaSGrid at your own company, book a meeting with the team.

Conclusion

Sales pipeline metrics are essential to the SaaS reporting stack. When done correctly, they help you:

forecast growth more accurately;

learn about the strengths and weaknesses of your team;

build a better GTM engine.

Because many of these metrics require complex data engineering to calculate, however, we often see them missing from companies’ reporting stacks. Thanks to SaaSGrid, you now have a shortcut to solve this problem.

___

Special thanks to SaaSGrid investor Brian Strubbe for his insights and feedback on this blog.

Effective analytics are the bedrock—they offer clarity, foster transparency, and incentivize business outcomes that matter. But numbers alone aren’t enough. True success comes when buyer and seller meet with aligned expectations and mutual understanding. The most powerful systems don’t add friction—they integrate seamlessly with workflow, guide behavior, and lighten the cognitive load of staying ahead. Analytics should support, not distract, from execution.

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e