Soon after a startup raises its Series A round, it begins to have board meetings for the first time, and I’m often asked what the agenda and format should be. This post describes my recommendations for SaaS board meetings. To make things easier, you can use this board deck template that my team and I developed with Quaestor.

Agenda

1) CEO Update: 30 minutes

The CEO’s overview should start at the 30,000 foot level and then dive into more detail. Remember that your audience is not as immersed as you are in the business and may need their memories refreshed in terms of where the last board conversation ended. Here are some helpful ways to structure the presentation:

What’s Going Well, What’s Not Going Well

I like seeing this on a single slide, two-column format, using bullet points. What major progress has occurred since the last board meeting? What are the biggest problems? What’s keeping you up at night? From my time as a founder, I know that no matter how well a startup is doing, there are always existential risks and problems. So nothing makes me queasier than receiving an all-positive update. This suggests that founders are either not aware enough or not paranoid enough about the real problems, or simply don’t trust the board enough to confide in them. It’s important to recognize that board members are not there to sit in judgment of you but rather to collaboratively problem-solve with you. If you’re not able to discuss the company’s biggest problems with them, you’re much less likely to make meaningful progress. You should choose your board members accordingly.

Strategic Learnings

The CEO should discuss their strategic learnings from the quarter. I like to think of this as the “diff” on the investor presentation: if you were to write your investor presentation today, what would be different compared to the last time you wrote it? What have you learned about your target customer since the last board meeting? How have you changed your market thesis? Are there any pivots you need to make? If you were to chain these diffs together, you should be able to see a clear path through the “idea maze” from one financing round to the next. I’ve noticed that unsuccessful startups tend to repeat the same conversations in every board meeting. The issues don’t change because there’s no progress through the idea maze. Don’t be afraid of making changes to the original plan; change indicates learning.

Company Priorities

What are the company’s top 3-5 priorities this quarter? In light of the strategic learnings mentioned above, CEOs should constantly be prioritizing and reprioritizing the most important initiatives. If you do OKRs, then this list of priorities can provide a first draft of your quarterly objectives. The board meeting is an opportunity to take in advice and feedback before distributing goals with your entire team. To avoid thrashing, create high-level alignment with your board, your exec team, then the whole company.

Context Setters and KPIs

Every SaaS business has a handful of KPIs that should be covered up front to gauge the health of the business and set context for the rest of the meeting. Here are the ones that I always like to see:

Runway. It’s always good to know how much cash is in the bank, the current monthly burn, and how much runway you have. Don’t bury the lede here. Nothing is worse than getting to the end of the meeting only to learn the business is almost out of cash and doesn’t have the degrees of freedom required to execute its plan. In that case, the board needed to have a completely different conversation.

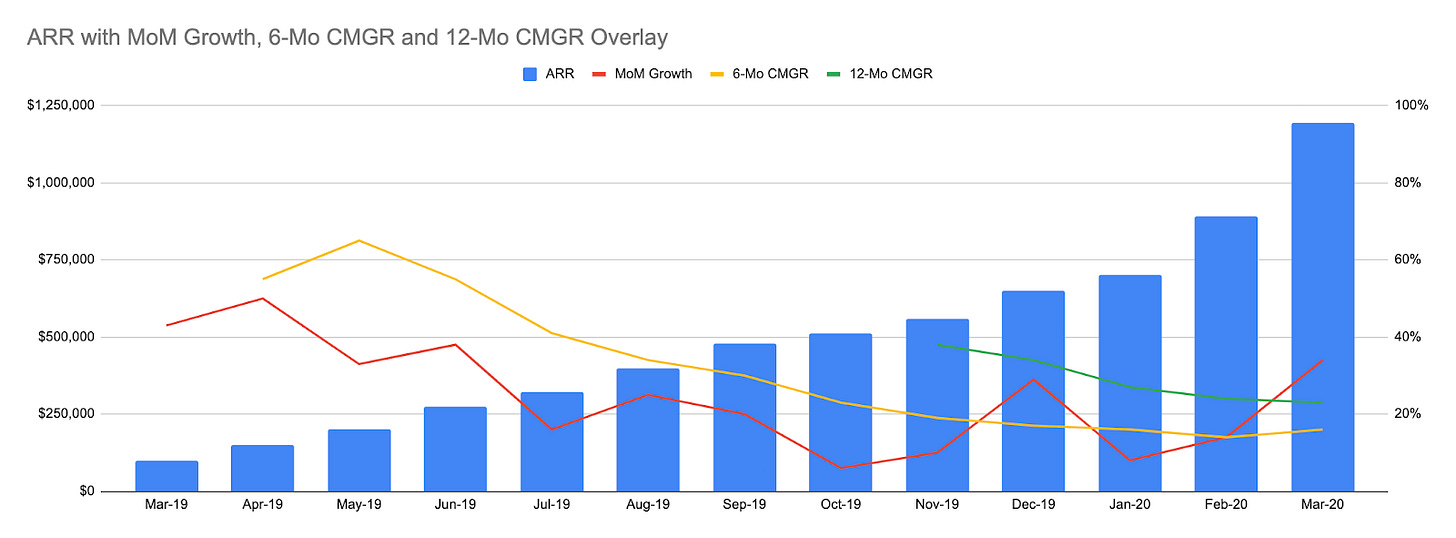

Revenue growth. How fast is revenue growing on a monthly basis? If you primarily sell annual contracts, you should use ARR as your key revenue metric. If you primarily sell monthly contracts, use MRR.

Net revenue breakdown. It’s important to understand how churn and expansion, as well as new sales, are contributing to your top line number. This can be shown on a single chart:

Cohorted retention. It’s also important to look at revenue retention by cohort to understand whether your subscriber base is growing or shrinking over time.

Engagement. Traditionally a consumer metric, user engagement also has relevance for bottom-up SaaS companies. The key metrics are DAU/WAU and DAU/MAU. Look at the crests to understand workday usage. Differentiate paid from unpaid users. It’s also helpful to see engagement for your top 10 customers.

Capital efficiency. Finally, I like to see metrics like Burn Multiple and CAC to understand the efficiency of growth.

2) Sales Update: 30 minutes

SaaS companies should hear from the head of sales in every board meeting. Since most of the company’s KPIs tether off sales, it’s the first departmental update. The head of sales should review:

The previous quarter’s results. What is the new ARR? Which deals closed? Provide color on major deals won or lost. What are common loss reasons, objections, missing features? What’s the competitive landscape?

The upcoming quarter’s pipeline. What is the forecast? What major deals are in the pipeline? What are the weighted pipe and coverage ratio? What changes are needed to hit the number?

Team performance. Rank the performance of sales reps by quota attainment. Who’s hitting or missing plan, and what can we learn from that to make the sale more repeatable? Do we have enough quota capacity to achieve our goals? What is the hiring plan for additional reps?

Finally, sales forecasts should be tracked using a waterfall chart so nobody forgets what was originally promised in relation to what was delivered:

3) Other Departmental Updates: 20 minutes

It’s good practice for the CEO to bring in department heads to present on their team’s progress. This helps to break up the meeting, give the CEO a break from presenting, and allow board members to get to know key executives. But usually, there’s not time for more than one departmental update per meeting, aside from sales.

Usually this is a product update. A discussion of sales objections naturally leads into a product roadmap conversation (because new features solve objections). Ideally, the roadmap should fit on one page (optionally, you can include mockups). While numerous product features launch every quarter, only the top priorities need to be discussed at the board level. The board’s job isn’t to micromanage product releases, but rather to make sure the roadmap is in line with the company strategy.

Other departmental updates are optional, and should not occur in every board meeting. You can rotate between departments, focusing on the one that has something important to report. For example, marketing might present after the annual user conference, telling us how it went. What was the reaction to the product? What are major stakeholders saying?

4) Financials: 10-20 minutes

This is an opportunity to dig deeper into financial topics. For example, if you’re planning to raise a new financing round, or if there’s a gross margin problem, or some other financial issue, this is the time to discuss it. For early stage companies, this section will be more brief; for more mature companies, the CFO will need to present in greater detail. As headcount and opex increase, more scenario planning is required in order to help a fast-growing startup avoid running into a wall.

5) Team: 10-20 minutes

This is an opportunity to discuss hiring needs and/or culture. Similar to strategic learnings, I find it helpful to focus on the “diff.” What does your ideal org chart look like compared to the one you have today? What areas are most on fire with the greatest need for new hires? In practice, you should focus on hiring roles that the team is desperate for, not ones that are a luxury item. Hiring is an area where board members should be able to help.

6) Administrative Matters: 5-10 minutes

Handle administrative matters at the very end, in closed session. There’s nothing worse than beginning a board meeting with housekeeping; it sucks the energy out of the room and will always expand to fill the time allowed. Board meetings should focus on strategic matters. (Housekeeping can also be done between meetings via Docusign.) Closed sessions are also an opportunity to handle any sensitive personnel matters.

Scheduling and Format

Here are the things to keep in mind as you schedule your board meetings:

Frequency. Board meetings should be quarterly. If your business is going through hard times and needs more frequent meetings, add a one-hour mid-quarter check-in. Monthly board meetings are counterproductive – if the team can’t execute the previous meeting’s decisions and measure the results within a month, what’s the point?

Length. Board meetings should be 2 hours long. When I was running companies, I used to think that 3 hours was the proper length. But now that I’m on the other side of the table, I can assure you that there are sharply diminishing returns on attention span after two hours.

Timing. For sales-driven companies (which almost all SaaS companies are), schedule your board meetings shortly after the quarterly close, so the sales data is conclusive and fresh. You don’t want to be speculating about how the quarter is going to go. You want to know how you just did. It fosters a much better conversation.

Location. Board meetings should be held in a private location. This is a non-issue in the Zoom era. But in real life, I’ve attended many an awkward board meeting in a glass conference room with paper-thin walls where no one felt comfortable discussing employee stock option grants, for example. When meetings go back to physical locations, choose a secure conference room, and if your startup doesn’t have one, then do it at the office of your VC firm or law firm.

Materials. Send the board materials 1-2 days ahead of time so board members have a chance to review the night before the board meeting. Also send a standard deck of KPIs; you won’t cover all of these in the board meeting, but it’s useful for the board to see the same metrics package every quarter. If you don’t yet have a standard set of KPIs for your business, hold a separate session with your Series A board member to discuss what that should look like. Our board deck template provides a good starting point.

David, this framework is extremely valuable. With the announcement of Craft III, what would you change in the deck to make it work for a Marketplace business (besides a greater focus on GMV)? Cheers!

For me, ¨Finally, sales forecasts should be tracked using a waterfall chart so nobody forgets what was originally promised in relation to what was delivered¨ this is an extremely important metric, perhaps the most. I like the visual graphs which for some strange reason isn´t a part of other sales organizations methods. Thank you David for providing such good detailed info and not of euphemisms and fluff. These details are what helps.